The 10

th China SIF Annual Conference was successfully held online on Dec. 14. The China Sustainable Investment Forum (China SIF) was launched by SynTao Green Finance in 2012, and has since gone through a full decade of exciting developments. During this decade, China SIF has witnessed the rapid development of ESG investment at home and abroad, with more and more financial markets incorporating ESG regulation and a growing number of financial institutions developing and launching ESG investment products.

The 10th China Sustainable Investment Forum (China SIF) Annual Conference is organised by SynTao Green Finance and co-hosted by the United Nations Environment Programme Finance Initiative (UNEP FI) and the United Nations Sustainable Stock Exchange Initiative (UN SSEi). This year's Conference was supported by strategic partners Moody's, Harvest Fund and AXA SPDB Investment Managers. As the grand finale of the 2022 China SIF Week, the 10th China SIF Annual Conference was themed "ESG Investing Comes of Age", looking back on the development of ESG from its emergence and rise to its gradual maturation into the mainstream over the past decade, and looking forward to the prospects, trends and key features of ESG investment in the next decade.

Professor and Executive Dean of the School of Public Policy and Management and the Executive Director of the Institute for Sustainable Development Goals of Tsinghua University, Prof. ZHU Xufeng, released the

Research on the ESG Rating System of Provincial and Municipal Governments (2022) (hereinafter as "the Report"). The study in the Report innovatively uses cities as the main ESG rating target, aiming to better promote sustainable transition and high-quality development of Chinese localities through the ESG rating process, and to guide the market and investors to jointly promote the sustainable development of cities.

Figure 1 Prof. ZHU Xufeng

Figure 1 Prof. ZHU Xufeng

Professor & Executive Dean, School of Public Policy and Management,

Executive Director, Institute for Sustainable Development Goals, Tsinghua University

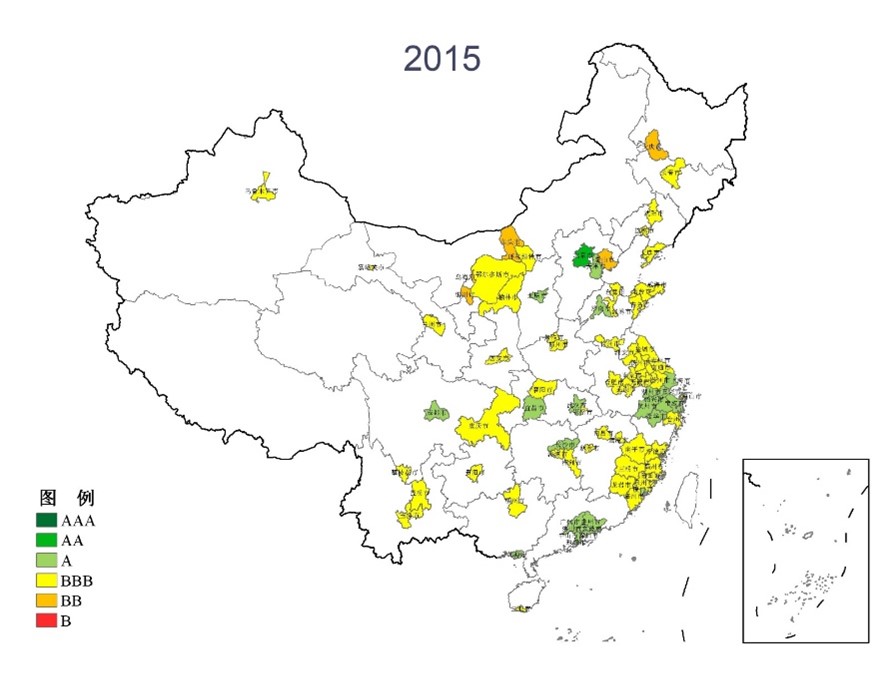

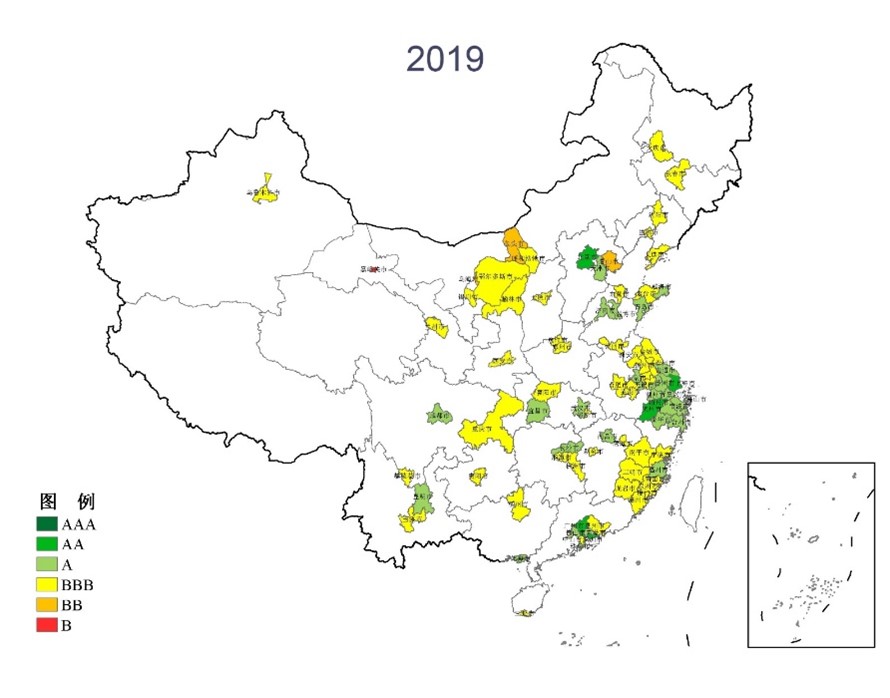

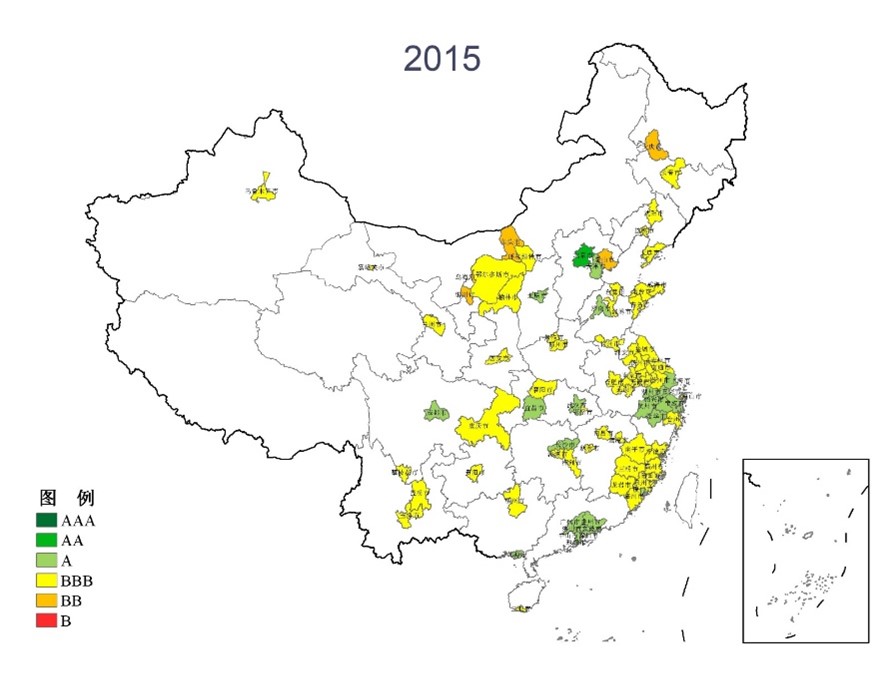

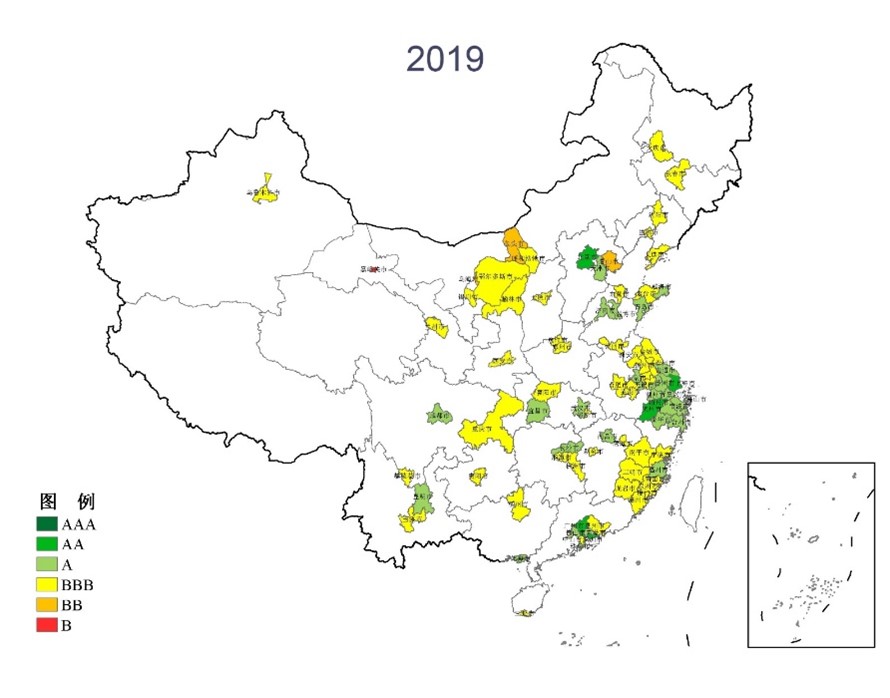

In the Report, the ESG evaluation index system for Chinese cities is constructed. Different cities are classified into six levels (from low to high) based on their ESG performance: B, BB, BBB, A, AA and AAA. A quantitative assessment of the overall and sub-dimensional ESG performance of the top 85 cities in China in terms of GDP per capita from 2015 to 2019 is also conducted. In addition, the Report also uses Guangzhou as an example and provides a more in-depth case study of Guangzhou's ESG performance.

The results show that the overall ESG performance of the 85 cities has been improving from 2015 to 2019. However, the average ESG performance of these cities is still at the moderate BBB level (Figures 2 and 3 only show the results for the cut-off years between 2015 and 2019). Economically developed cities in the eastern coastal region perform better. In contrast, inland cities in the central and western regions perform relatively poorly.

Figure 2 Overall ESG Rating Results for 85 Cities, 2015

Figure 3 Overall ESG Rating Results for 85 Cities, 2019

Specifically in terms of the E, S and G dimensions: in the E dimension, the environmental performance of the 85 cities has improved considerably, with a relatively balanced level of development in the eastern, central and western regions; in the S dimension, the social performance of the 85 cities has improved year on year, but the overall level is relatively average, with a high level of heterogeneity in the social development of different cities; in the G dimension, the governance level scores of the 85 cities are relatively low overall, with a relatively slow rise.

Prof. ZHU Xufeng emphasised that the significance of studying the ESG rating of local governments in China is: to help deepen the reform of the administrative system and promote the transition of local government functions towards scientific development; to encourage local governments to implement the concept of green and innovative development; and to enhance social governance and social participation at the local level.

The study was supported by Moody's and SynTao Green Finance. It was written independently by the research team from Tsinghua University's Institute for Sustainable Development Goals. Finally, on behalf of the Institute and the research team, Prof. ZHU Xufeng expressed his gratitude to the two supporting organisations. Dr. GUO Peiyuan, Chairman of SynTao Green Finance and the moderator of the China SIF Annual Conference, said that SynTao Green Finance appreciated the opportunity to work with the research team of Tsinghua University's Institute for Sustainable Development Goals and would like to explore the rating system and relevant data developed so far with all parties in the market to promote its practical application.

The Report is part of a series of research reports on ESG rating indicators for local governments in China. The results have been published continuously since 2021. The complete 2022 Report will be published on the official WeChat account of Tsinghua University's Institute for Sustainable Development Goals. Please stay tuned for more.

The 10th China SIF Annual Conference and the 2022 China SIF Week 2022 is supported by media, including Securities Times, Sina Finance and house.china.com.cn. Acknowledgements to: Responsible Investment Association of Australasia (RIAA), Caixin International, CDP, Ford Foundation (Beijing Office), International Finance Corporation, International Capital Markets Association (ICMA), Korea Sustainability Investing Forum (Kosif), Sustainable Banking and Finance Network (SBFN), Lianhe Equator, Norwegian Forum for Responsible Sustainable Investment (Norsif), Europe- based national Sustainable Investment Fora (EuroSIF), Cliumate Bonds Initiative (CBI), Global Sustainable Investment Alliance (GSIA), Sweden's Sustainable Investment Forum (SweSIF), SynTao Consulting, Shenzhen Finance Institute, Shenzhen Stock Exchange, CUEB China ESG Institute, CCM CSR Promotion Centre, iFinD, Wind Content Conference Community, Asia Investor Group on Climate Change (AIGCC), UK Partnering forAccelerate的ClimateTransitions(UK PACT), UK Sustainable Investment and Finance Association (UKSIF), and Yuze Charity for the contribution to 2022 China SIF Week.

Prior to the Annual Conference, 2022 China SIF Week has already hosted a series of 11 Side Events covering various aspects of responsible investment such as Sustainable Agriculture, Bond Markets for Sustainable Development, Net Zero Investment Trends in Asia and Asset Owners' Expectations on ESG Investment in China, Academic Workshop on ESG Practice and Investment Return, Training on Sustainable Blue Economy and Climate Change Management, TCFD Training for Listed Companies, Climate and Sustainability Disclosure in Stock Exchanges, Wealth Management for A Good Cause, China's Overseas Responsible Investments and ESG Information Disclosure for Enterprises, etc. In addition, we have contacted eight organisations from the Global SIFs Network to jointly look at the next decade of global responsible investment in a webinar format.

More than 2,000 professionals from around the world registered for the 10th China SIF Annual Conference and 2022 China SIF Week. 8,265 views were recorded on the day of the live broadcast through the China SIF website (chinasif.org), Wind 3C Conference, iFinD Terminal and WeChat video, with a total of 114,254 minutes of viewing time. The number of registrations and live streams watched reached a new record high. Click "Read More" to fill in the registration information and get the link to the playback of the 2022 China SIF Week events.

About China SIF

China Sustainable Investment Forum (China SIF), established in Beijing as a non-profit organisation in 2012, was officially registered as a private non-enterprise unit in Shenzhen in 2016, the Jifeng Green Finance Promotion Center of Shenzhen City, is dedicated to promoting responsible investment and to provide an internationalised platform for exchanging and sharing ideas on issues concerning sustainable development, with focus on facilitating Environmental, Social and Governance (ESG) integration, advocating green finance, and contributing to a responsible capital market in China as well as its sustainability.

Since the establishment, China SIF has held 10 Annual Conferences, 5 Summer Summits, 6 China SIF Weeks, and a series of featured seminars and webinars, convening policymakers as well as domestic and foreign experts to share their views, research, and good practice. Professionals and practitioners from research institutes, financial institutions, listed companies, government agencies, as well as representatives from media have joined our discussion and endeavor to explore multiple ways to promote and practice responsible investment and green finance.

China SIF keeps launching a series of landmark research reports, such as China Sustainable Investment Review, supporting the Dissertation Competition on ESG and Sustainable Finance and developing the "ESG Online Classes" series of educational videos together with partners and industry experts to promote ESG investment concepts and practices. Over the years, China SIF has become one of the most influential responsible investment forums in the region.

Please visit

https://en.chinasif.org/ for more information.