The EU's Sustainable Finance Disclosure Regulation (SFDR) and China's Environmental Disclosure Guideline for Financial Institutions both indicate that climate, environmental and ESG information disclosure by financial institutions is becoming a policy hotspot, both to address climate and environmental risks and to prevent "greenwashing".

On December 7, 2021, at the 9th China SIF Annual Conference in Beijing, guests from rating agency, commercial banks, ESG data provider, and law firm discussed the latest practices and challenges faced by financial institutions on climate (environmental) disclosure in a parallel forum in the afternoon.

Mr. Nicholas Zhu, Vice President and Senior Credit Officer at Moody's Investors Service, began by affirming the value of environmental information disclosure by financial institutions from the perspective of a rating agency. He noted that more demanding disclosure rules should drive more comprehensive reporting of the climate risks associated with banks' portfolios over time. They will help them reduce their carbon exposure and improve their resilience to climate stress.

Ms. Yin Hong, Deputy Director of Urban Finance Research Institute at ICBC, focused her keynote speech on the environmental information disclosure of financial institutions in the context of carbon neutrality, pointing out that carbon neutrality will have a profound impact on financial institutions from multiple perspectives, including policy, industry and market, and that how to integrate carbon neutrality target into green financial systems and information disclosure frameworks is one of the directions that need attention. As for disclosure guidelines and frameworks, TCFD has become the mainstream framework for climate information disclosure. ICBC, who co-chairs China-UK Climate and Environmental Information Disclosure Pilot Group, has made positive progress in promoting research on environmental information disclosure by financial institutions and the application of TCFD.

Ms. Rebecca Mikula-Wright, Chief Executive Officer of the IGCC and the AIGCC, shared international climate and environmental disclosure trends, presenting relevant tools by the IGCC and AIGCC to help investors include environmental and ESG-related information in their investment portfolios. Rebecca pointed out that, judging from the practice in several countries and regions, investors' demand for transparency in investment products will gradually shift from voluntary to mandatory disclosure of climate and environmental information.

The panel discussion was then moderated by Dr. Guo Peiyuan, Chairman of China SIF and SynTao Green Finance. Five panelists shared their views, including Ms. Wang Ting, General Manager of the Japan Research Institute (Shanghai) Solution Co.,Ltd, Mr. Zhang Dachuan, Executive Director, Alternative Investment Department, Huaxia Wealth Management Co., Ltd., Ms. Alessandra Oglino, Head of Business Development at RepRisk, Mr. Ma Jiangtao, Senior Partner at Dentons Beijing Office and Dr. Dong Shanning, the Deputy General Manager of Green Finance and Corporate Finance at the Bank of Jiangsu.

Ms. Wang Ting introduced the relevant practices of the Japanese financial regulators and the Japanese banking industry, pointing out that Japan already has semi-mandatory requirements for non-financial information disclosure for specific companies. At present, there are no uniform standards and guidelines for the disclosure of environmental information by financial institutions in Japan, and financial institutions mainly refer to international standards, with TCFD being the most commonly cited.

Mr. Zhang Dachuan shared the progress of Huaxia Wealth Management's research on climate and environmental information disclosure. He believes that climate information disclosure can contribute to risk mitigation and opportunity identification. However, barriers still remain, such as the lack of high-quality carbon emission data, and connecting daily transactions to medium and long-term scenario modelling.

From the perspective of data service providers, Ms. Alessandra Oglino argued that there is an urgent need to improve the transparency and comparability of ESG data. She believed that ESG data providers should drive capital decisions by providing timely and transparent ESG data that genuinely provides an early warning of risk rather than an afterthought. She noted that the early traditional approach to ESG integration, which focused on scoring metrics through sourcing ESG data, is no longer the case. Companies, investors, academics, and the media increasingly demand ESG ratings and research metrics to drive the true integration of ESG factors.

Mr. Ma Jiangtao shared his views from legal perspective. He pointed out that, from a macro perspective, the recent "1+N" policy system on carbon neutrality in China has raised the requirement for carbon disclosure; From a micro perspective, more and more local regulators and market institutions have issued relevant regulations and reports, which indicates environmental disclosure has become a clear trend. Mr. Ma suggested further that the relevant legal and access management issues should be further studied to define the boundaries and responsibilities of the disclosure more clearly.

Dr. Dong Shanning introduced the Bank of Jiangsu's practices in environmental information disclosure. As a member of the China-UK Climate and Environmental Information Disclosure Pilot Group, the Bank of Jiangsu has made a lot of progress in developing an environmental information disclosure framework and environmental stress testing. He also mentioned some difficulties for the banking sector: poor data availability, inconsistent disclosure standards, and unclear usage of disclosure information.

Finally, Dr. Guo Peiyuan summarized the parallel forum. He argued that the value of climate disclosure by financial institutions is affirmed and clear. It can help improve transparency, reduce risk exposure and identify new opportunities. Still, data availability and other issues pose constraints to high-quality disclosure. In addition, policies and markets need to create greater incentives for financial institutions.

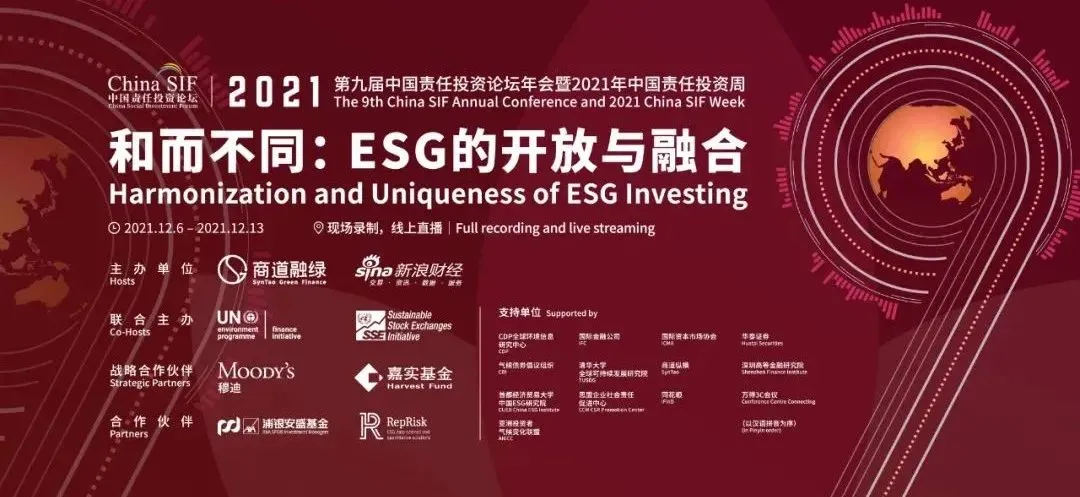

The 9th China SIF Annual Conference

Dec. 7th 2021 Beijing 08:45-17:30

Theme: Harmonization and Uniqueness of ESG Investing

Hosts: SynTao Green Finance, Sina Finance

Co-Hosts: United Nations Environment Programme Finance Initiative (UNEP FI), United Nations Sustainable Stock Exchange Initiative (UN SSEi)

Strategic Partners: Moody's, Harvest Fund

Partners: AXA SPDB Investment Managers, RepRisk

Supporters: CDP, IFC, ICMA, Huatai Securities, CBI, TUSDG, SynTao, Shenzhen Finance Institute, CUEB China ESG Institute, CCM CSR Promotion Center, iFinD, Conference Centre Connecting, AIGCC, UK PACT

(in PINYIN order)