STGF Insights

SynTao Green Finance launches the "ESG Rating Insights" Series to Provide an In-depth Analysis of Chinese Companies' ESG Performance.

SynTao Green Finance,2023.08-2024-03

SynTao Green Finance is committed to providing professional ESG rating results and effective data for financial institutions. The ESG Rating Insights section provides investors with in-depth insights and analysis on the ESG performance of Chinese companies, and continues to track corporate ESG information disclosure, ESG performance, key ESG issues, ESG risks, sector research and more! Stay tuned!

U.S. New SEC Climate Disclosure Rules Released, Covering Five Key Areas (Chinese Only)

SynTao Green Finance,2024.03.08

The SEC Climate Disclosure Rule is the result of a compromise between all parties, and since the release of the draft rule in March 2022, the SEC has received more than 24,000 feedback comments, which is highly controversial. The rule's implementation will likely be influenced by partisan politics and interest groups.

SynTao Green Finance Assists Orient Securities with Climate Scenario Analysis (Chinese Only)

SynTao Green Finance,2024.03.13

SynTao Green Finance's Carbon and Climate Scenario Analysis Platform ("the Platform") is designed to help companies and financial institutions plan for climate risk. Recently, SynTao Green Finance assisted Orient Securities in conducting a climate scenario analysis through the Platform, which analysed in detail the differences in physical and transition risk exposures as well as the climate resilience of its portfolio under different climate scenarios.

Scope Three of Financial Institutions as a "Structural Adjustment" Indicator (Chinese Only)

SynTao Green Finance,2024.03.25

Carbon accounting by financial institutions is inconsistent. Scope 3 accounting is considered to be more technical than the other two. Scope 3 is a "structural adjustment" indicator, and the main types of business for which indirect emissions are emitted vary between financial institutions. For banks, indirect emissions from lending dominate; for fund managers, indirect emissions from equities and bonds dominate; and for securities managers, Scope 3 includes both financed emissions and facilitated emissions.

Policy Update

Shanghai Municipal Commission of Commerce,2024.03.01

On March 1, the Shanghai Municipal Commission of Commerce released the Three-Year Action Plan for Accelerating the Environmental, Social and Governance (ESG) Capabilities of Foreign-Related Enterprises in the City (2024-2026). It sets the goal of "establishing an ESG ecosystem for foreign-related enterprises by 2026, in which the municipal government, industry associations, foreign-related enterprises and professional service institutions participate together and develop synergistically".

Beijing Municipal Administration for Market Regulation,2024.03.12

Recently, the National Standardization Administration Committee and the People's Bank of China jointly issued the Notice on Issuing the Pilot Project on Comprehensive Standardization of Social Management and Public Services (in the Field of ESG Evaluation of Financial Institutions), and the Pilot Project on Standardization of ESG Data Evaluation Services in the Financial Field of the Beijing Financial Science and Technology Industry Alliance.

EU Council Approves Scaled-Back Environmental, Human Rights Sustainability Due Diligence Law

ESGtoday,2024.03.15

On March 15, EU member states in the European Council announced that they had reached an agreement on a key piece of legislation, the Corporate Sustainability Due Diligence Directive (CSDDD), which imposes mandatory obligations on companies to address their negative impacts on human rights and the environment and to promote its implementation, after a compromise was reached to drastically downsize the new law. The compromise could ultimately save the Corporate Sustainability Due Diligence Directive (CSDDD).

General Office of Suzhou Municipal Government,2024.03.20

The Economic Development Commission of Suzhou Industrial Park (SIP) officially released the "Action Plan for ESG Industry Development in SIP" and "Several Measures to Promote ESG Development in SIP" to the public. The main measures include encouraging project settlement, supporting growth and strengthening, promoting infrastructure construction, and supporting industrial agglomeration.

Market Update

How Effective is the Exclusion of High-Emission Companies from the Sustainability Fund?

Principles for Responsible Investment,2024.03.15

Some popular sustainable investment strategies tend to build portfolios of low-emission "green" companies while reducing or excluding so-called "brown" companies with high emissions. Research suggests that this dominant sustainable investment strategy may actually be counterproductive. When brown companies are penalized with a higher cost of capital, they are incentivized to pollute more of the environment for immediate cash. On the other hand, rewarding companies that are already green does little to improve their environmental impact.

ESG Investment Instruments Update

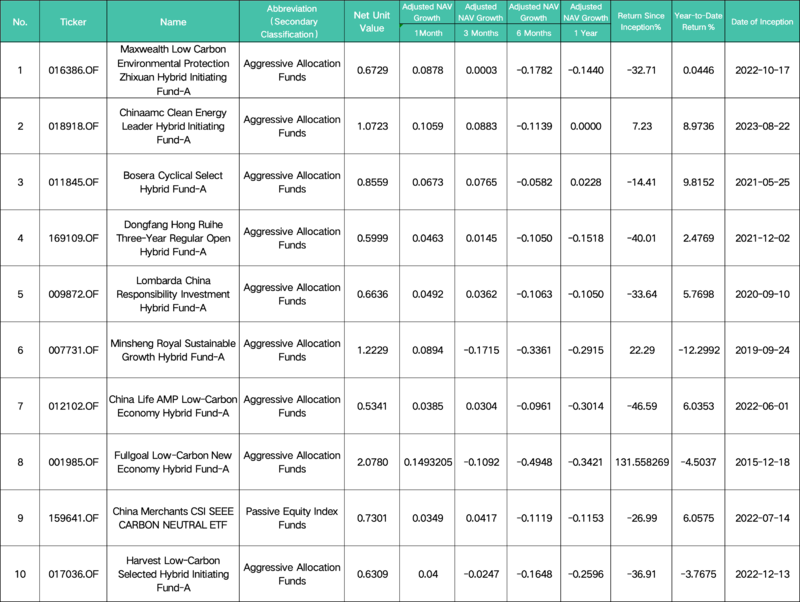

ESG Funds Ranking in March

Note: This list screens the top 10 ESG funds by the percentage of peer group fund interval returns. The peer group funds include Equity Blend, Common Equity, International (QDII) Equity, Flexible Allocation, Enhanced Index, Passive Index, and Balanced Blend funds.

Data source: Wind Data Terminal, compiled by SynTao Green Finance

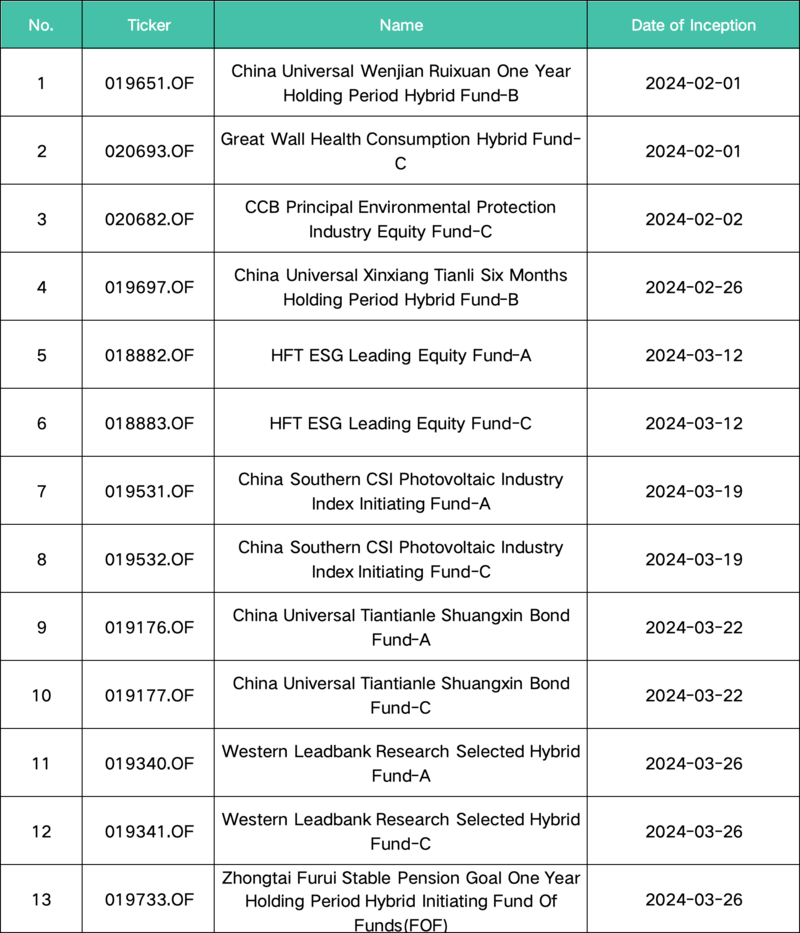

New ESG Funds in February and March

ESG Indices

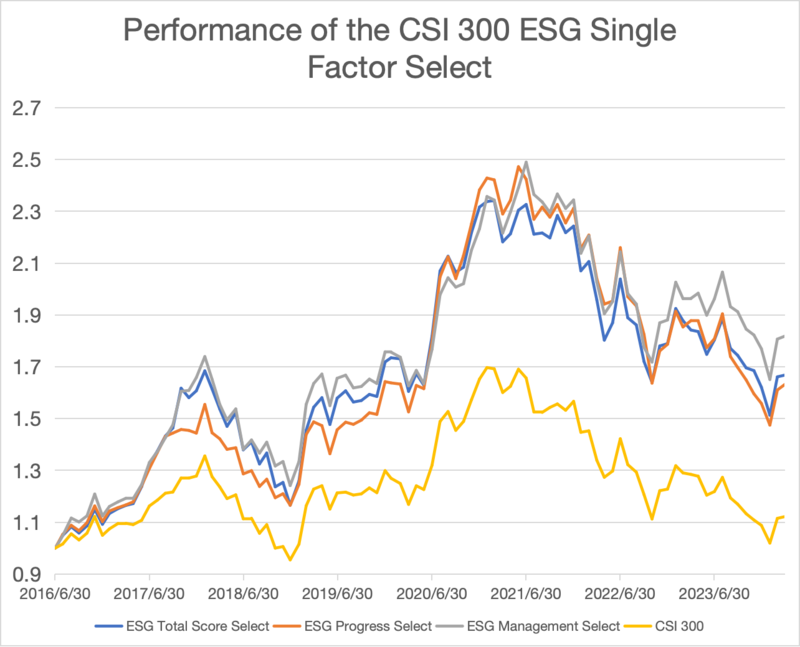

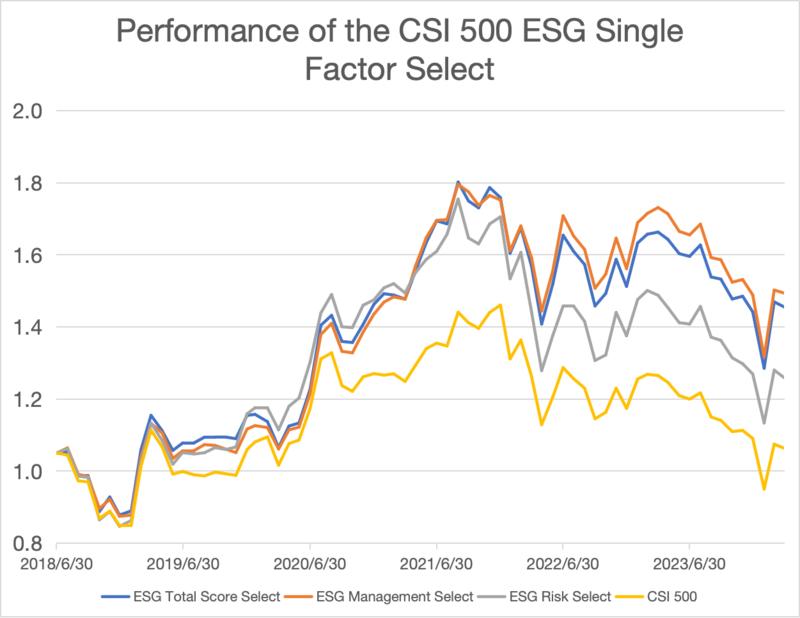

Based on a systematic assessment of the ESG performance of listed companies, SynTao Green Finance has developed a series of index strategies built around ESG factors. Within the CSI 300 and CSI 500, respectively, it has constructed a single-factor ESG meritocratic strategy index, preferentially selecting the top 20% of stocks; it has also constructed a weighting tilting strategy without changing the index components, tilting the weighting to companies with higher ESG score improvement companies and companies with higher ESG management scores.

As the end of March 2024, the excess returns of the CSI 300 ESG Single Factor Index, ESG Total Score Optimal Index, ESG Progress Optimal Index and ESG Management Optimal Index relative to the CSI 300 Index for the last six months were -0.25%, 0.27% and -0.81% respectively; the CSI 500 ESG Single Factor Index, ESG Total Score Optimal Index, ESG Management Optimal Index and ESG Risk Selective Index over the CSI 500 Index for the last six months:1.89%, 1.08% and -0.79% respectively.

ESG Controversies

Environmental Controversies

On Mar 14, Yuntianhua's (600096.SH) subsidiary was fined a total of over 16.7426 million yuan for water pollution.

On Mar 20, Shaanxi Coal Industry's (601225.SH) joint venture was fined 390000 yuan for violating hazardous waste management regulations.

On Mar 20, GD Power's (600795.SH) joint venture was fined 390000 yuan for violating hazardous waste management regulations.

On Mar 31, a holding company Of CNNC (601985.SH) was fined 982000 yuan for violating environmental compliance.

Social Controversies

On Feb 29, a roof accident occurred in a coal mine of China Shenhua (601088.SH), resulting in one death.

On Feb 29, Weihai Huafa Real Estate, a subsidiary of Huafa Group (600325.SH), was fined 4.55 million yuan for illegal construction.

On Mar 4, Shenzhen OCT (000069.SZ) Happy Valley Tourism Company was fined 300,000 yuan for collision caused by illegal special equipment.

On Mar 12, a flash explosion accident occurred at a subsidiary of Shanxi Coking Coal Energy (000983.SZ), resulting in one death.

On Mar 20, the 19-year-old who passed away after donating blood at the Tiantan Biological (600161.SH) Blood Donation Station was revealed to have donated blood "16 times in eight

On Mar 21, Dongqu Coal Mine, a subsidiary of Shanxi Coking Coal Energy (000983.SZ), was fined 2.6 million yuan for poor management of accident hazards.

On Mar 22, an accident occurred at Hanjiawa Coal Industry, a subsidiary of Shanxi Coking Coal Energy (000983.SZ), resulting in one death.

On Mar 23, CITIC Securities (600030.SH), as a sponsor, was initiated on-site supervision by the Shenzhen Stock Exchange.

On Mar 28, an accident occurred at a subsidiary of Hunan Gold (002155.SZ), resulting in one death.

On Mar 29, the investigation results of the falling death case of employees from China Construction (601668.SH) Fifth Bureau have been released, and a number of people have been taken into custody.

On Mar 30, two sponsoring representatives of Zhejiang Securities (601878.SH) were disciplined for violating business rules.

On Mar 31, an accident occurred at Gequan Mine under Jizhong Energy (000937.SZ), resulting in 2 deaths.

Governance Controversies

On Feb 24, five relatives of Qiu Molin, chairman and real controller of Hengyi Petrochemical (000703.SZ), were fined 27.12 million yuan for insider trading..

On Feb 25, China Construction (601668.SH) First Bureau was fined more than $978,800 for illegal subcontracting on a construction project.

On Mar 1, CIMC (000039.SZ) and a number of its subsidiaries were sued for alleged infringement of intellectual property rights, with a claim of 19.8137 million US dollars.

On Mar 13, Zhu Youshan, former president of Agricultural Bank of China (601288.SH) Huanggang Branch, and You Minquan, former president of Dongpo Branch, are under investigation for suspected serious violations of discipline and law.

On Mar 13, Shenzhen Gas (601139.SH) was fined 674600 yuan for price violations.

On Mar 15, Li Yong, former Deputy Secretary of the Party Group and General Manager of CNOOC (600938.SH), is under investigation for suspected serious violations of discipline and law.

On Mar 15, Zhou Jun, former chairman of Shanghai Pharmaceuticals (601607.SH), has been expelled from the party and public office for serious violations of discipline and law.

On Mar 19, CosMX Battery (688772.SH) was found to be liable for infringement compensation in the first instance of its product patent infringement case.

On Mar 20, Wu Canqi, former deputy general manager of Sinopec (600028.SH) branch, has been arrested on suspicion of bribery.

On Mar 20, Zhongtai Chemical (002092.SZ) is under investigation for suspected illegal information disclosure.

On Mar 22, Liu Anlin, former Party Secretary and President of China Life Property Insurance (601628.SH), is under investigation for suspected serious violations of discipline and law.

On Mar 25, Zhongtai Chemical's (002092.SZ) controlling shareholder is under investigation for organizing and instructing listed companies to engage in illegal information disclosure activities.

On Mar 25, Jiang Tao, Chairman of Beidahuang (600598.SH) Agricultural Service Group, is under investigation for suspected serious violations of discipline and law.

On Mar 27, Weifu High-Technology (000581.SZ) was criticized in a notice for inaccurate performance forecasts.

On Mar 28, Zhongtai Chemical's (002092.SZ) controlling shareholder is to be fined 5 million yuan for disclosure violations.

On Mar 28, Zhongtai Chemical (002092.SZ) is to be fined $5 million for financial fraud.

On Mar 29, Zhao Wenge, Chairman of Small Commodity City (600415.SH), is accused of damaging the interests of subsidiaries and is sued for compensation of 5 million yuan.

On Mar 29, Yang Guoyue, former inspector of the Security Department of Agricultural Bank of China (601288.SH), was sentenced in the first trial for bribery.

On Mar 29, Shu Jing, former member of the Party Committee and Vice President of Chongqing Rural Commercial Bank (601077.SH), is under investigation for suspected serious violations of discipline and law.

On Mar 30, Guo Baichun, Chairman of Asia-Potash International (000893.SZ), is suspected of dereliction of duty and has been investigated and detaine.